EVERYDAY WEALTH IN AMERICA 2023 REPORT

What does it mean to be “wealthy” today? For the second year, ĂŰѨĘÓƵ explored the intersection of life and money, revealing new insights into Americans’ attitudes about wealth including our biggest financial concerns, the impact of social media, the role finances play in our relationships and much more.*

Ěý Ěý

Ěý Ěý Ěý

PERCEPTION OF WEALTH

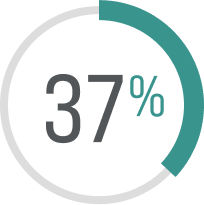

Few Americans consider themselves wealthy

believe they are wealthy, similar to 12% in 2022

But more people this year believe they need $1M+ to feel wealthy:

Ěý

67%

in 2023

Ěý

57%

in 2022

Ěý Ěý

Ěý Ěý Ěý

WEALTH CONCERNS

Political Worries are Up

Ěý Ěý Ěý Ěý Ěý

Top 3 concerns for affluent Americans

Ěý

Ěý

Ěý90%

Current political environment

87%

Inflation

81%Impact of 2024 election

Ěý Ěý

Ěý Ěý Ěý

OBSTACLES TO BUILDING WEALTH

CREDIT CARD DEBT IS A MAJOR ROADBLOCK

see credit card debt as their biggest barrier to building wealth in 2023.

see credit card debt as their biggest barrier to building wealth in 2023.

Ěý Ěý

Ěý Ěý Ěý

WEALTH AND HOMEOWNERSHIP

Ěý

Ěý

of potential homebuyers say the real estate environment has discouraged them from buying a home.

THE IMPACT

OF SOCIAL MEDIA

Ěý

Ěý

Americans say they feel less satisfied with the amount of money they have because of social media.

WEALTH AND RELATIONSHIPS

Ěý

Ěý

of those with a significant other have fought over finances and money.

Ěý Ěý

Ěý Ěý Ěý

THE VALUE OF A PROFESSIONAL

Working with

a financial Professional can help ease the Emotional burden

say they stress less about finances because they work with a financial professional

Ěý

of those surveyed currently work with a financial professional.

Ěý Ěý

Ěý Ěý Ěý

Dive Deeper

Explore additional insights from Everyday Wealth in America 2023.

Media Contact:Ěý

PRTeam@EdelmanFinancialEngines.com

INTERESTED IN LAST YEAR’S REPORT?

Check out Everyday Wealth in America 2022.

The 2023 Everyday Wealth in America research was conducted for ĂŰѨĘÓƵ by Greenwald Research. Information was gathered through an online survey of 2,022 Americans who were at least 30 years old, from August 28 to September 8, 2023. The total sample included an oversample of 1,013 “affluent” respondents between the ages of 45-70, with household assets between $500K-$3M, and currently working with a financial professional or open to doing so. Data was weighted to correct for the affluent oversample and was also weighted by household assets, age, gender, race, and education to reflect the broader national population. If randomly conducted, the survey would have a margin of error (at the 95% confidence level) of plus or minus 2 percentage points.

AM2602602